Philadelphia Npt Interest And Penalties . an npt return must be filed irrespective of whether not the business has an office or business location in the city. You will not receive written. (a) each person whose net profits are. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. interest and penalty shall be added to the amount of tax not paid by the statutory due date. Net profits tax is due by businesses organized as: (1) returns and payments of estimated tax. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,.

from www.formsbank.com

You will not receive written. Net profits tax is due by businesses organized as: an npt return must be filed irrespective of whether not the business has an office or business location in the city. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. (a) each person whose net profits are. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. interest and penalty shall be added to the amount of tax not paid by the statutory due date. (1) returns and payments of estimated tax. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,.

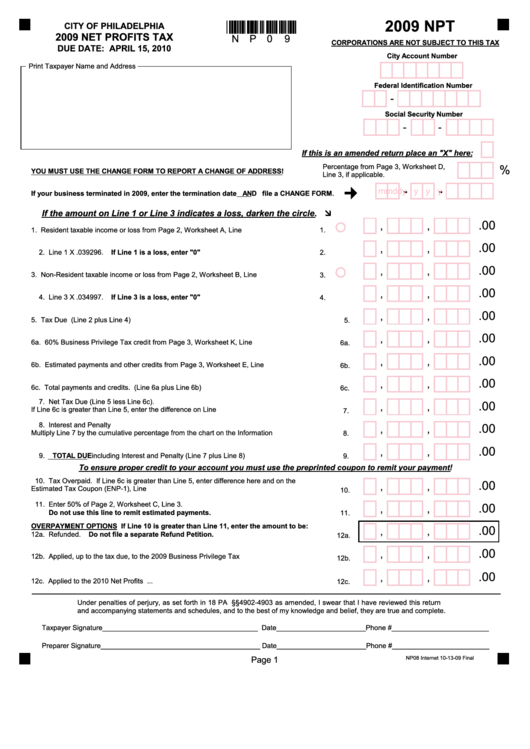

Form Npt Net Profits Tax City Of Philadelphia 2009 printable pdf

Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. (1) returns and payments of estimated tax. (a) each person whose net profits are. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. interest and penalty shall be added to the amount of tax not paid by the statutory due date. an npt return must be filed irrespective of whether not the business has an office or business location in the city. Net profits tax is due by businesses organized as: if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. You will not receive written. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically.

From www.researchgate.net

NPT sequencing for wells 83 and 23. Operators show different reporting Philadelphia Npt Interest And Penalties interest and penalty shall be added to the amount of tax not paid by the statutory due date. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. You. Philadelphia Npt Interest And Penalties.

From www.emcaaccounting.ca

Interests and Penalties on Late Taxes in Canada You Should Avoid Emca Philadelphia Npt Interest And Penalties the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. interest and penalty shall be added to the amount of tax not paid by the statutory due date. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. (a) each person. Philadelphia Npt Interest And Penalties.

From www.taxuni.com

Calculator For IRS Penalty And Interest Philadelphia Npt Interest And Penalties Net profits tax is due by businesses organized as: if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. (a) each person whose net profits are. interest and penalty. Philadelphia Npt Interest And Penalties.

From blog.saginfotech.com

GCCI Requests FM to Waive Off IGST Penalty and Interest Philadelphia Npt Interest And Penalties You will not receive written. interest and penalty shall be added to the amount of tax not paid by the statutory due date. (1) returns and payments of estimated tax. Net profits tax is due by businesses organized as: if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete. Philadelphia Npt Interest And Penalties.

From www.thetechsavvycpa.com

The Truth About Penalty and Interest Abatement with the IRS The Tech Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. (1) returns and payments of estimated tax. (a) each person whose net profits are. You will not receive written. Net profits tax is due by businesses organized as: if your accrued interest is under $15,000 and your accrued penalty is under $35,000,. Philadelphia Npt Interest And Penalties.

From www.chegg.com

Solved On July 1, 2023, the beginning of its fiscal year, Philadelphia Npt Interest And Penalties if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. You will not receive written. Net profits tax is due by businesses organized as: (1) returns and payments of estimated tax. (a) each person whose net profits are. interest and penalty shall be added to the. Philadelphia Npt Interest And Penalties.

From taxwalls.blogspot.com

How To Calculate Penalties And Interest On Taxes Tax Walls Philadelphia Npt Interest And Penalties (a) each person whose net profits are. (1) returns and payments of estimated tax. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. interest and penalty shall be added to the amount of tax not paid by the statutory due date. an npt return must be. Philadelphia Npt Interest And Penalties.

From www.saraltds.com

Details on TDS penalty and interest for late payment Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. (a) each person whose net profits are. an npt return must be filed irrespective of whether not the business has an. Philadelphia Npt Interest And Penalties.

From dsdc.com.vn

The difference between penalty for violation and compensation for Philadelphia Npt Interest And Penalties interest and penalty shall be added to the amount of tax not paid by the statutory due date. an npt return must be filed irrespective of whether not the business has an office or business location in the city. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and. Philadelphia Npt Interest And Penalties.

From www.chegg.com

Solved Please help with the following entries, only ones Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. interest and penalty shall be added to the amount of tax not paid by the statutory due date. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. (a). Philadelphia Npt Interest And Penalties.

From www.youtube.com

No Interest and penalty in QRMP scheme under GST Interest & Penalty Philadelphia Npt Interest And Penalties Net profits tax is due by businesses organized as: taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. You will not receive written. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. if your accrued interest is under $15,000. Philadelphia Npt Interest And Penalties.

From www.signnow.com

Philadelphia Net Profits Tax 20212024 Form Fill Out and Sign Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. You will not receive written. (1) returns and payments of estimated tax. interest and penalty shall be added to the amount of tax not paid by the statutory due date. the philadelphia net profits tax (npt), which is imposed on the. Philadelphia Npt Interest And Penalties.

From shop.taxguru.in

Interest, Fee & Penalty under Tax Act books at 27 Discount Philadelphia Npt Interest And Penalties (a) each person whose net profits are. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. Net profits tax is due by businesses organized as:. Philadelphia Npt Interest And Penalties.

From www.freelancejobsdb.com

Calculation of interest and penalties FreelanceJobsDB Philadelphia Npt Interest And Penalties Net profits tax is due by businesses organized as: (a) each person whose net profits are. You will not receive written. (1) returns and payments of estimated tax. the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. an npt return must be filed irrespective of whether not. Philadelphia Npt Interest And Penalties.

From www.formsbank.com

Form Npt Net Profits Tax City Of Philadelphia 2009 printable pdf Philadelphia Npt Interest And Penalties interest and penalty shall be added to the amount of tax not paid by the statutory due date. You will not receive written. (1) returns and payments of estimated tax. Net profits tax is due by businesses organized as: (a) each person whose net profits are. the philadelphia net profits tax (npt), which is imposed on the net. Philadelphia Npt Interest And Penalties.

From www.dochub.com

Philadelphia npt Fill out & sign online DocHub Philadelphia Npt Interest And Penalties You will not receive written. (a) each person whose net profits are. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. (1) returns and payments of estimated tax. Net profits tax is due by businesses organized as: an npt return must be filed irrespective of. Philadelphia Npt Interest And Penalties.

From www.youtube.com

Interest and Penalty on late filing of GST Return YouTube Philadelphia Npt Interest And Penalties taxpayers who owe $5,000 or more for the birt/npt are required to pay those taxes electronically. You will not receive written. if your accrued interest is under $15,000 and your accrued penalty is under $35,000, you can download and complete a petition for. (a) each person whose net profits are. an npt return must be filed irrespective. Philadelphia Npt Interest And Penalties.

From www.tax-usa.net

Philadelphia BIR and NPT tax return Tax USA Inc. Philadelphia Npt Interest And Penalties an npt return must be filed irrespective of whether not the business has an office or business location in the city. You will not receive written. Net profits tax is due by businesses organized as: the philadelphia net profits tax (npt), which is imposed on the net profits from the operations of a trade, business,. (a) each person. Philadelphia Npt Interest And Penalties.